Facts to Consider Before Getting a Home Improvement Loan

A home improvement/renovation/repair loan is a secured loan that is covered by collateral and is used to fund a home’s renovation. The improvement has to aesthetically improve the house and make it more comfortable to live in. Here, you will know if a loan may or may not be suitable for you.

• Collateral – A home renovation loan requires collateral that is created by mortgaging the home that is to be subjected to remodeling. Sometimes, other assets such as cars may also be used as collateral.

• Factors affecting the loan – The amount, interest and the repayment period are dependent on numerous factors. These include the location and the size of the property for which the loan is to be applied. The second factor is the credit history of the loan applicant. Homeowners with a good credit history can procure better terms and conditions on their loans. In contrast, an owner with a bad history may find it extremely difficult to procure a loan approval. The final factor is the age and the condition of the property on which the loan is applied for. The owners receive higher amounts on properties that are not very old and in good condition.

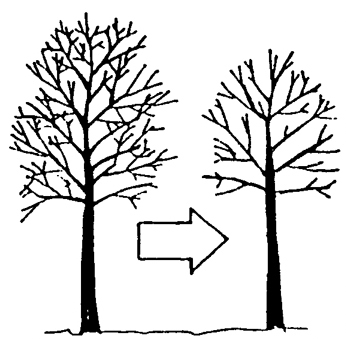

• Advantages – Getting a loan enables you to improve your property. Such improvements could result in an increase in your home’s market value and provide it with a longer life. The house also becomes more comfortable to live in. There are many lending institutions providing this type of loan. Therefore, owners can get the best interest rates and larger amounts to carry out the remodeling. A loan that has been correctly considered is beneficial in the long run. This is because the market value of an improved property is higher than the original price of the property and the amount of the loan taken.

• Disadvantages – Though a home improvement loan can be advantageous you, there are certain downsides. In a fluctuating economy, the terms and the interest rates charged on the loan can become stringent. This makes it costlier and more difficult for you to apply for this loan. The application procedure could be cumbersome and confusing. Moreover, the sanctioning terms and other requirements are strict and owners with a slightly bad credit history may find it tough to avail it. You will have to offer your house title as collateral. This creates a lien on the asset making it almost impossible for owners to sell their assets though there are still other options to take.

Before applying for a loan, search extensively for available options. If you have a problem with credit history, you may consider getting expert advice on how to improve it or to get better interest rates. You can use the online home improvement loan calculator to estimate the sanctioned amount and interest payout on the loan. With adequate research and knowledge on the terms and conditions, you can substantially benefit from this loan. Getting a home loan is not a joke as it is something that takes years to pay for, so you must carefully consider your options first before making a choice.