Home Private Woodland Retreat: A Cozy Haven in Nature’s Embrace

A Cozy Haven in Nature’s Embrace

In the hustle and bustle of modern life, finding solace in the midst of nature has become a luxury. One such retreat that promises tranquility and serenity is the Home Private Woodland. Let’s delve into the essence of this hidden gem and explore why

Home Forest Escape: Tranquil Living Amidst Nature’s Embrace

Discovering Tranquility: Home Forest Escape Unveiled

A Natural Haven: Embracing Forest Serenity

Approaching Home Forest Escape feels like entering a natural haven of tranquility. The entrance, adorned with towering trees and the soft murmur of a nearby stream, extends a serene welcome. This sets the stage for an immersive experience,

Nurturing Tomorrow: The World of Tree Saplings

Nurturing Tomorrow: The World of Tree Saplings

Planting tree saplings is a powerful act that contributes to the future health of our planet. This article explores the significance of tree saplings, from their role in environmental conservation to practical tips for planting and caring for them. Let’s delve into the

Serenity in Nature: Idyllic Forest Living

Harmony with Nature: Discovering Home Idyllic Forest

Nestled within the arms of nature, Home Idyllic Forest stands as an epitome of tranquility, offering a haven where modern living seamlessly integrates with the serenity of the forest. Let’s delve into the enchantment of this idyllic woodland retreat and explore the unique

Reviving Discards: Transforming Home Rejects into Treasures

Reviving Discards: Transforming Home Rejects into Treasures

Rediscovering Value: The Potential within Home Rejects

In the world of home rejects, where items are often dismissed as unwanted or obsolete, lies a hidden realm of untapped potential. Rediscovering value within these rejects involves shifting perspectives and recognizing the opportunities for transformation

Smart Solutions for Efficient Home Waste Management

Smart Solutions for Efficient Home Waste Management

Waste management at home is a challenge many of us face, but with the right tools and strategies, it becomes a manageable and even eco-friendly endeavor. In the quest for efficient home waste management, the humble home rubbish bin plays a pivotal role.

Navigating the Challenges of Home Dump Issues

Navigating the Challenges of Home Dump Issues

Understanding the Home Dump Phenomenon: A Growing Concern

In the realm of environmental challenges, the issue of home dumping has emerged as a significant concern. Homeowners and communities grapple with the consequences of improper waste disposal, leading to environmental degradation and health hazards.

Balancing Act: Navigating the Challenges of Home Excess

Navigating the Challenges of Home Excess: Striking a Balance

In the quest for comfort and convenience, many homes find themselves teetering on the edge of excess. This exploration delves into the challenges posed by home excess, examining its impact on well-being, the environment, and offering practical strategies for achieving a

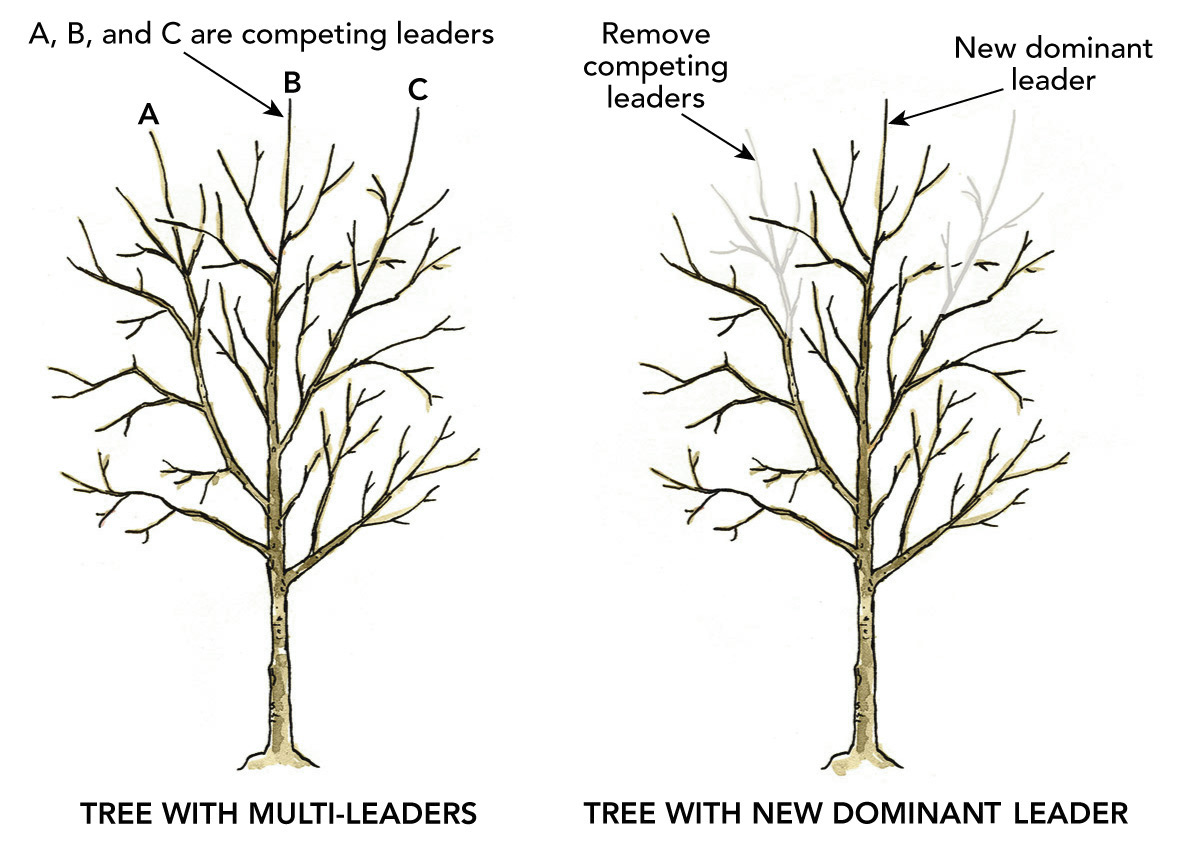

Essential Tree Maintenance for Healthy and Vibrant Greenery

Introduction:

Effective tree maintenance is vital for preserving the health and vibrancy of your greenery. This article delves into the importance of regular tree maintenance, the key practices involved, and the benefits of investing time and effort into caring for your trees.

Tree Maintenance Link:

For comprehensive guidance on tree

Precision Tree Pruning: Enhancing Health and Aesthetics

Introduction: The Art and Science of Precision Tree Pruning

Tree pruning is both an art and a science, requiring precision and knowledge to enhance the health and aesthetics of trees. In this article, we delve into the principles and practices of precision tree pruning, exploring its benefits and providing insights